416-428-2165

aisham@rumanek.com

SETTLE YOUR DEBT WITH PROFESSIONAL ASSISTANCE

- Complete the assessment.

- Lower monthly repayments.

- Write off debt you can't pay.

- Legal protection from your creditors.

- Start your journey to financial freedom

CONSUMER PROPOSALS

ARE HELPING CANADIANS.

CONSUMER PROPOSALS

Why Consider a Consumer Proposal?

If you need debt relief and wish to regain your financial freedom, a consumer proposal (CP) may be the answer. A consumer proposal is introduced as a means to decrease your existing debts and then settle the remaining debt balance over a five-year period.

A state of insolvency can prove challenging, but consumer proposals provide a way to manage debts and alleviate your financial burden without harsh impact on your credit score. Once debts are reduced, the next step is to work on improving your credit. To work towards improved financial status, we examine the impact of outstanding debt on your credit, the process of a consumer proposal and ways of building good credit.

WE KNOW EACH CLIENT FACES UNIQUE FINANCIAL

CIRCUMSTANCES AND ENSURE EVERY DEBT SOLUTION

IS TAILORED TO OUR CLIENT'S SPECIFIC NEEDS.

CONSUMER PROPOSALS AND CREDIT SCORES

HOW DEBT IMPACTS

YOUR CREDIT SCORE.

Credit is commonly referred to as your overall credit history and as determined by the financial bureau. A creditor can issue a report to the financial bureau concerning outstanding debts. It is your credit report that reveals such outstanding debt. Depending on your debt, you are assigned a rating or “credit score.” This will provide other creditors with an indication of your financial risk when looking to take out future credit. Such ratings allow a creditor to learn about your debt repayment patterns and the time taken to settle such debts.

HOW A CREDIT SCORE IMPACTS YOUR FINANCIAL HEALTH.

Whether you need a mortgage to buy a home or seek financing, you may come across many obstacles if your credit score is not up to par. Lenders often restrict specific services and products on credit to those with a poor credit history. If you have a low credit rating, you will have to seek alternative finances to cover the necessary costs. The most common scenarios affected by credit ratings include home loans, credit cards, car financing and related services

HOW CAN A CONSUMER

PROPOSAL HELP?

A consumer proposal will help you avoid the possibility of bankruptcy. It can help you protect your financial status depending on your debt sum. The total of your debts should not exceed $250 000 without including a mortgage. To qualify for a CP, a fixed income is viewed favorably; however, financial contributions from friends or relatives can serve as an agreed upon CP payment.

WORKING ON YOUR CREDIT RATING WITH A CONSUMER PROPOSAL.

When you seek a consumer proposal, it can assist with debt relief and contribute to an improved credit rating. While consumer reports do not change a score overnight, with your efforts, it can be significantly improved. To achieve a positive credit rating, you need to adhere to a few best practices during the CP process.

What is the Time Taken to Develop a Healthy Credit After a Consumer Proposal?

While you may not want to, the best way to rebuild your credit rating is to loan money and start a strict repayment plan. Before reaching out for a credit card or loan, always develop a financial plan you can stick to.

Prepare a Suitable Budget

When you work towards a consumer proposal, you will receive a copy of your income expenses as listed by the LIT or Licensed Insolvency Trustee. This serves as a great way to develop a healthy budget to achieve financial success, but you must be strict with your repayments. A budget assists in creating a savings for set expenses and other costs incurred through the month. Always keep money aside to support your financial needs should unexpected events occur.

We recommend $1000 in savings to address an emergency situation.

Once you have some finances in place and a budget you can work with, you can start improving your credit.

Achieving an R1 rating is a possibility with diligence and determination.

SETTLE YOUR DEBT WITH PROFESSIONAL ASSISTANCE

- Complete the assessment.

- Lower monthly repayments.

- Write off debt you can't pay.

- Legal protection from your creditors.

- Start your journey to financial freedom

SETTLE YOUR DEBT WITH PROFESSIONAL ASSISTANCE.

- Complete the assessment.

- Lower monthly repayments.

- Write off debt you can't pay.

- Protection from your creditors.

Answer a few simple questions to get a

personalized debt relief blueprint.

Write off up to 80% of unsecured debts

and receive professional advice.

Answer a few simple questions to get a personalized debt relief blueprint.

Write off up to 80% of unsecured debts and receive professional advice.

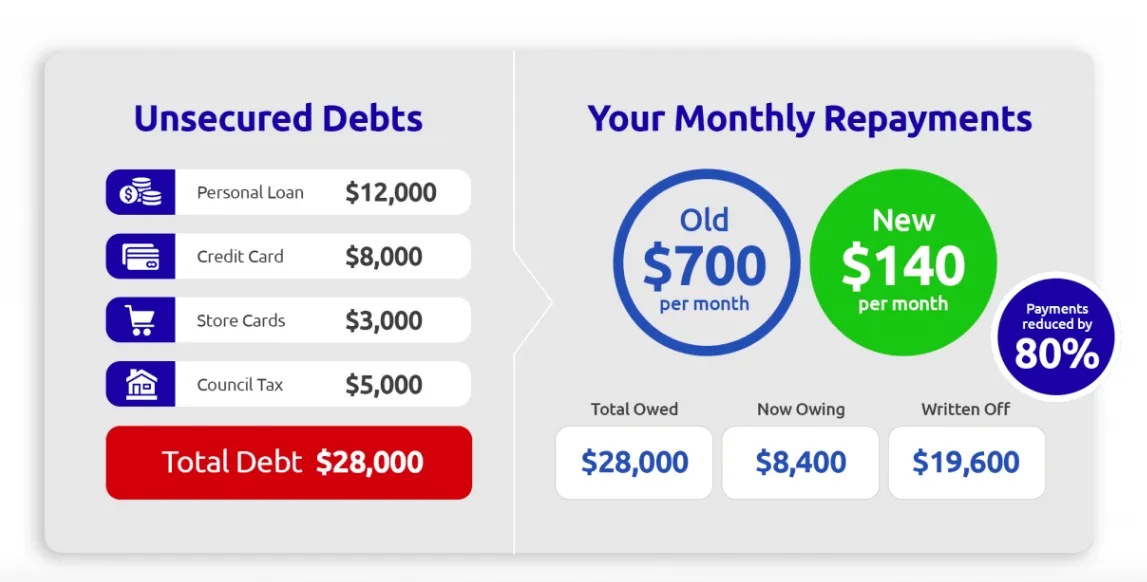

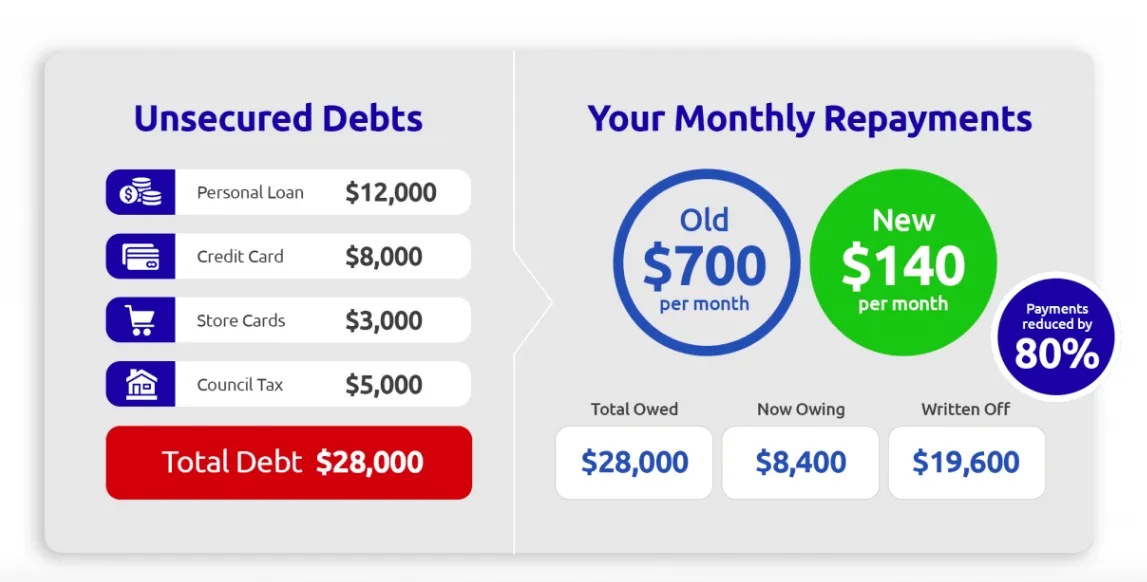

HERE'S AN EXAMPLE OF WHAT I CAN DO FOR YOU.

If you're struggling to pay back your debt, have a look at one of our recent cases below to see how much you could save.

TAKE CONTROL TODAY.

Stop the Anxiety

- Stop Collection Calls

- Stop Lawsuits

- Stop Paying High Interest

- Stop Wage Garnishment

- Stop Struggling

HOW WE HELP OUR CLIENTS.

I will advise you on debt solutions that will allow you repay what you can afford and help you on the path to a debt free life.

About Me.

Aisha Munawar

Licensed Insolvency Counsellor

Debt Solutions Specialist

Aisha is a Licensed Debt Solution's Specialist and Insolvency Counsellor with Rumanek and Company Ltd (Licensed Insolvency Trustee). She is well-known in community for her professionalism, ethics and expertise. With more than 18 years of experience in Insolvency industry she possesses unrivaled commitment to supporting and empowering clients towards creating a debt-free future. Her commitment to quality service is within all aspects of her work, including facilitating initial consultations, helping and assisting debtors in Debt Relief Solutions Bankruptcy and Consumer Proposals, negotiating with creditors and performing credit counselling’s. With exceptional interpersonal and communication skills, Aisha deals with the cases of potential and existing clients with the utmost confidentiality, compassion and care. Her practice is in line with the rules and regulation of the Bankruptcy and Insolvency Act and Directives issued by the Office of the Superintendent of Bankruptcy Canada. Aisha is fluent English, Urdu, Hindi and Punjabi..

Anna was struggling with debts before finding out about Rumanek ...

"Long story short, I wrecked up a good amount of debt due to life circumstances. At that point, I tried going to the banks and asking friends for help. Nothing was leading me to a sustainable solution, until I saw a facebook ad for Rumanek (bless those cookies!).

Honestly, their proposal seemed too good to be true, to this day I can't believe they helped me. I got set-up with a plan that worked for me, they took the time to educate me on how to become more financially literate. I used to work for one of the top 5 banks in Canada, and I promise you...that bank has no interest in helping their consumers while Rumanek is actually invested in your success.

Now I am officially debt free and rebuilding my credit score. I have now an emergency fund, saving funds for first home, and currently enrolled in school (paid in full!). None if this would be possible if it wasn't for Rumanek's team.

I will definitely recommend their services to my friends and family."

• Anna G. | Toronto, ON

1280 Finch Ave. West, Suite 714, Toronto, Ont, CA. M3J 3K6

aisham@rumanek.com

416-428-2165

416-428-2165

© 2020 Rumanek & Company Ltd. All Rights Reserved.

Your privacy is important to us. As such we comply with The Personal Information Protection and Electronic Documents Act (PIPEDA) which provides rules for how to collect, use and disclose this information. Rumanek may receive payment from product providers. All financial solutions are subject to affordability checks, credit check and asset valuations.

By submitting this form, I expressly consent to authorizing Rumanek & Company Ltd. it's agents and affiliates, to contact me using an automated telephone dialling system and artificial

or pre-recorded messages at the number provided, on mobile devices (including SMS and MMS), and e-mail, even if I am on a Corporate, Provincial, or National

Do-Not-Call registry. I understand this is not a condition of purchasing any goods and services and that I may revoke my consent at any time.